Basics of Personal Finance - 01

Disclaimer - These are notes and takeaway from re-reading Chapter 2 - Don't Stash that cash from Monika Halan's book on personal finance Let's Talk Money.

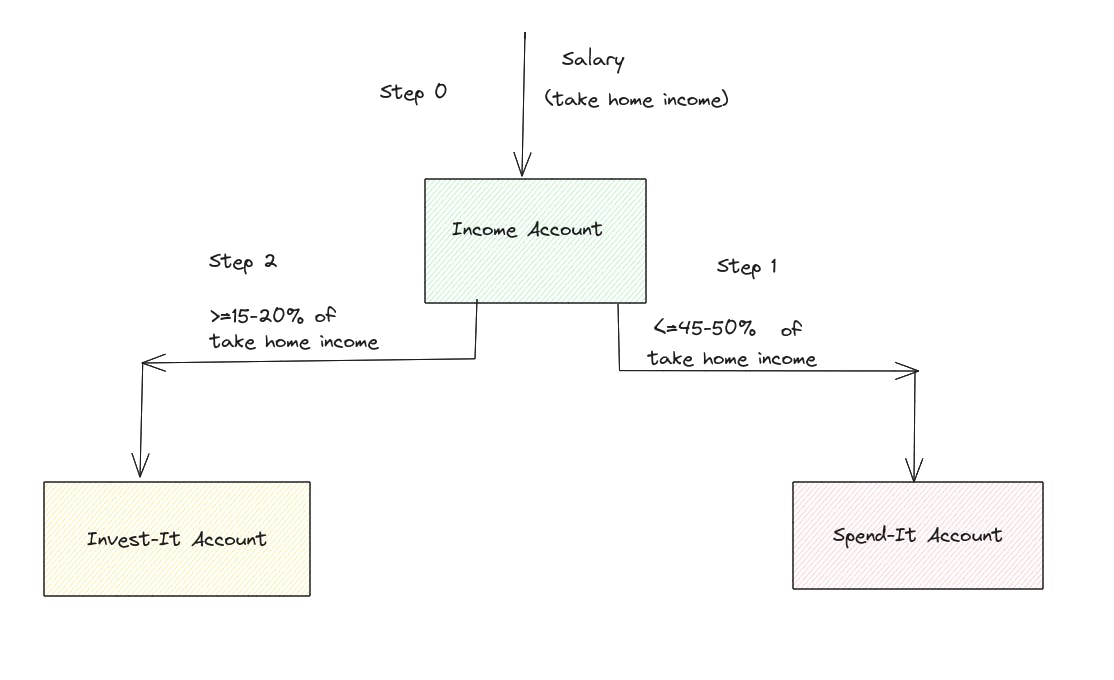

1. Have 3 separate bank accounts. Label each of the accounts Income Account, Spend-it account and Invest it account respectively.

As soon as you receive take home salary in your income account. Move atleast 40-45% of your take home salary to spend-it account. EMI payouts should not be more than 25-30% of your take-home income. Move 15-20% of your take home salary to invest-it account. Savings should at-least be 15-20% of take-home income.

Set a calendar alert if the month ahead has premium payment due for a medical, house, car, term plan and move that much more money to take care of additional spend.

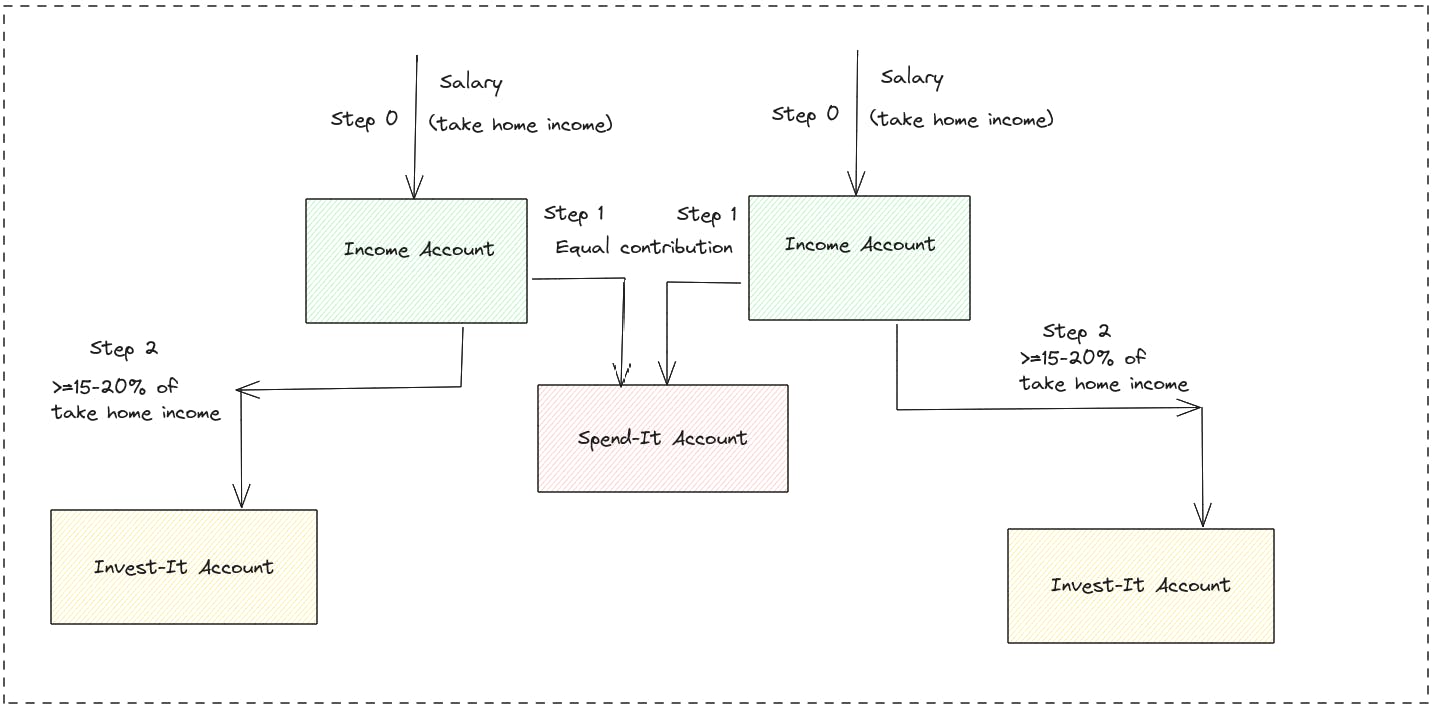

Steps to do if you have a partner

4. You and your spouse/brother/sister whoever contributes in your household expenses both should have a joint account into which both credit equal amounts for monthly spending.

5. Each partner has a separate invest-it account in different banks.

4. Follow this and monitor each of your accounts for 3 months. This way you would be able to identify if your spending's are more, are your savings on track?

5. Moving money from invest-it account to spend-it account is not allowed.