Build your Emergency Fund - 02

Disclaimer: These are not my thoughts on emergency fund. These are notes and takeaways from Chapter 03 - Emergencies need a fund of Monika Halan's book on personal finance Let's Talk Money.

This is the fund that will only be used in case of emergency. Consider this as a piggy bank that you break only when you need money for an unplanned emergency.

How much do you need?

1. Keep aside 6 months of living costs. Include everything in it - Rent, EMI, school fees, utilities, premiums, credit card charges.Plus any other monthly expense. Monthly expenses can be figured out based on how much money you are transferring monthly to your spend-it account. As discussed in 01 part of this series.

2. 6 months is the average, you can increase or decrease this amount based on your personal situation.

3. Lower the risk to the household, lower is the number of months spending you need to cover for in the emergency fund. And, higher the risk, higher the amount you save.

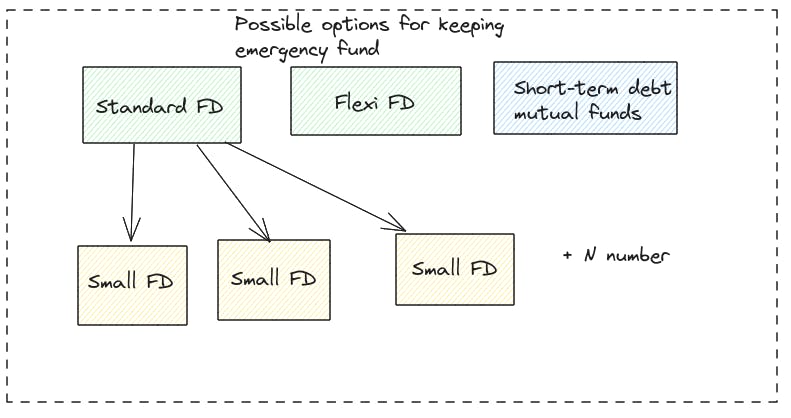

Where do you keep this money?

1. Keep it at a place is not that easy to access. Yet is liquid enough to be of use when you want it and gives a return that is better than a savings deposit.

2. The best understood product is fixed deposit. Emergency fund can be split into smaller FDs so that you don't have to loose the interest on the entire deposit.

3. People familiar with mutual funds can opt for short-term debt funds. Before putting money in FD. Understand debt funds it has several advantages over FD.

4. Before doing any long term investments. Build your emergency fund. Set a monthly target. And, keep crediting your emergency account each month. Once target is achieved stop crediting.